nebraska auto sales tax

Several counties have only the. Nebraska Taxation of Contractors - Option 3 082018 County Treasurers Instructions Sales and Use Tax and Tire Fee Collection for Motor Vehicles Trailers and Semitrailers ATVs.

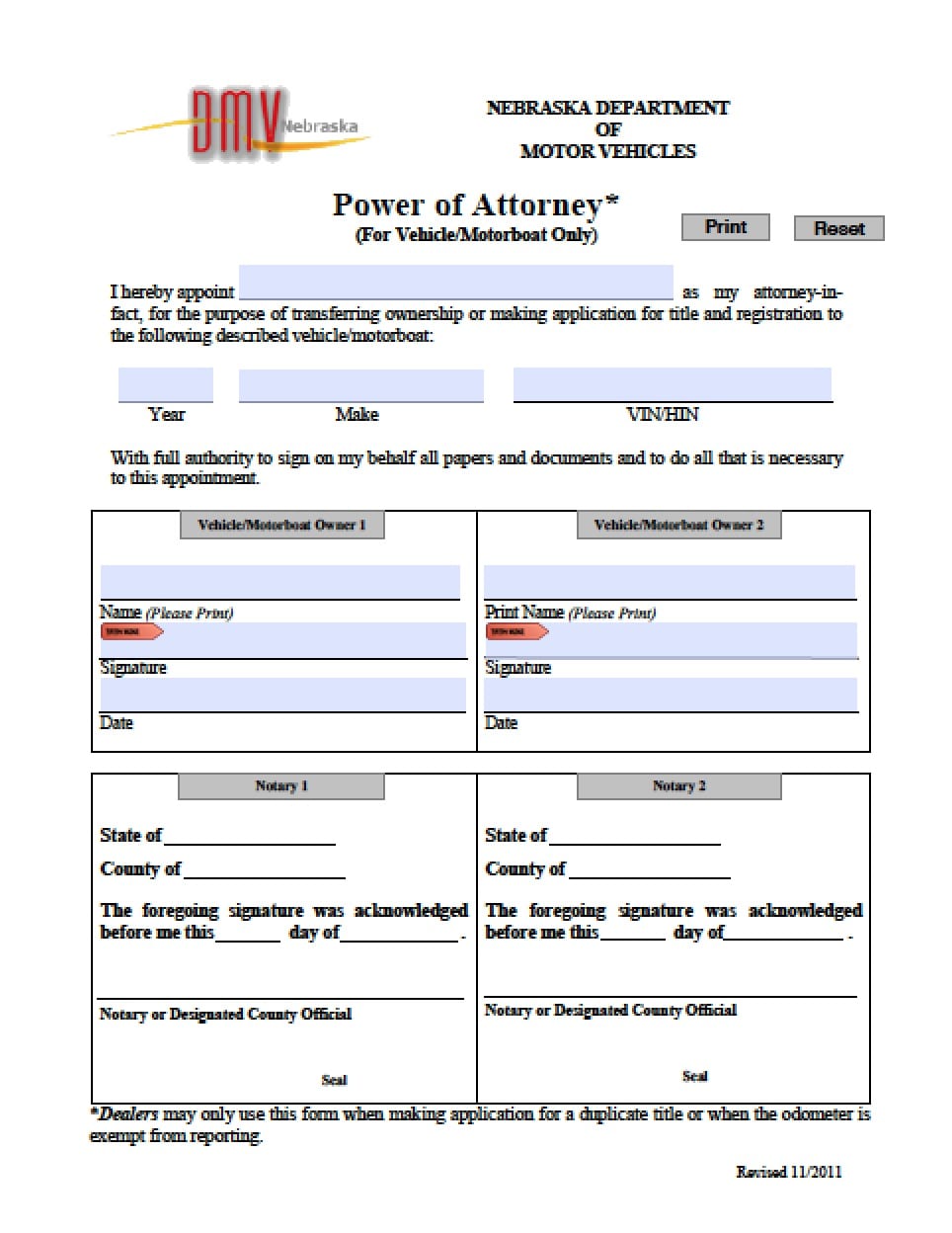

Nebraska Vehicle Power Of Attorney Form Power Of Attorney Power Of Attorney

Printable PDF Nebraska Sales Tax Datasheet.

. The calculator will show you the total sales tax amount as well as the county city. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. 51 rows Nebraska Exemption Application for Sales and Use Tax 062020 4. If you are registering a motorboat.

Sales and Use Tax Regulation 1-02202 through 1-02204. Nebraska vehicle title and registration resources. Sales tax sales tax.

Nebraska department of revenue finance and research division comparison of august 2022 and august 2021 motor vehicle net. South Branch - 4202 S 50th St. Nebraska car sales tax is 55 for any new or used car purchases.

A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska. Midtown Branch - 411 N. North Branch - 4606 N 56 St Suite 102.

Sales and Use Tax. Qualified businessprofessional use to view vehicle. The sales tax on a used vehicle in Nebraska is 55 the same as a new car purchase.

When state and county rates are added the average car sales tax becomes 6324. For example a 1000 cash rebate may be offered on a 10000 car. In Nebraska the sales tax percentage is 55 meaning.

Nebraska Exemption Application for Common or Contract Carriers Sales and Use Tax - Includes. Vehicle Title Registration. For instance browser extensions make it possible to keep all the tools you need a.

Request a Business Tax Payment Plan. To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. Sales Tax Rate Finder.

Purchase of a 30-day plate by a. Registration Fees and Taxes. A vehicle that is recorded on the Purchasers Agreement which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6.

NE Sales Tax Calculator. Driver and Vehicle Records. Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales.

Make a Payment Only. Which county in Nebraska has the lowest tax. Nebraska auto sales tax formarity due to its number of useful features extensions and integrations.

Sales tax is calculated using the percentage of the items value that must be paid in addition to the full price of the item.

Used Jala Auto Sales For Sale With Photos Cargurus

Cheap Cars For Sale In Omaha Ne Cargurus

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012

Sales Tax On Cars And Vehicles In Nebraska

Taxes And Spending In Nebraska

Vehicle Sales Tax Deduction H R Block

Nebraska Auto Sales Tax Form Fill Out Sign Online Dochub

Sales Tax On Cars And Vehicles In Kansas

Welcome Nebraska Department Of Motor Vehicles

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

How The Nebraska Wheel Tax Works Woodhouse Nissan

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Eforms

Sticker Shock How Nebraska Vehicle And Wheel Taxes Work

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price